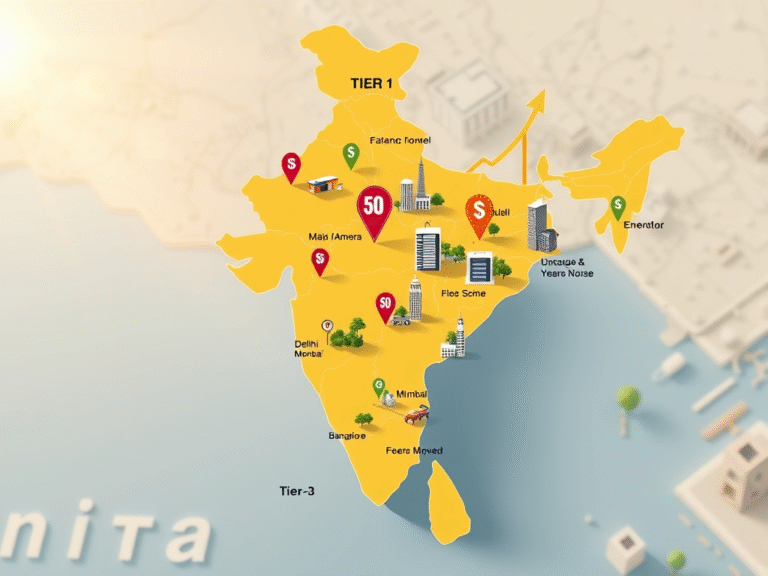

Real Estate Investment in Tier-1, Tier-2, and Tier-3 Cities: A Comprehensive Guide

The real estate market is witnessing a significant surge in demand for homes priced between Rs 1-2 crore in tier-1 cities. This trend is attracting investors towards premium projects as buyers increasingly look beyond saturated metropolitan areas. They are weighing affordability against growth opportunities in emerging corridors. Making informed real estate choices requires a thorough understanding of evaluating property across different city tiers, each with unique dynamics. Factors such as property prices, infrastructure development, and job creation are reshaping investment strategies. In this article, the current trends and their implications will be explored to assist individuals in making informed decisions regarding real estate investments.

Understanding Property Prices and Affordability in Different City Tiers

Property prices in tier-1 cities, including Delhi-NCR, Mumbai, Bangalore, Chennai, Hyderabad, Pune, Kolkata, and Ahmedabad, are experiencing steady growth. The luxury segment, particularly homes in the Rs 1-2 crore range, is driving sales. In contrast, tier-2 cities like Jaipur, Coimbatore, Lucknow, and Chandigarh are attracting buyers with more accessible property prices. Rapid infrastructure development and job creation in these areas enhance affordability. Meanwhile, tier-3 cities, such as Aligarh and Meerut, offer lower property rates, but their growth is comparatively slower.

To make informed decisions, consider these indicators when comparing property prices across city tiers:

- Tier-1 cities maintain higher prices due to consistent demand.

- Tier-2 cities provide a balance of affordability and strong growth potential.

- Tier-3 cities have lower entry costs but experience gradual appreciation.

- Align budgets with realistic expectations rather than headline discounts.

These insights form the foundation for evaluating property options. The next step is to assess whether the potential returns justify the risks involved.

Evaluating ROI and Rental Returns Across City Tiers

The demand for housing in tier-1 cities remains robust, driven by migration and population growth. Residential properties in these areas often yield steady appreciation. Additionally, rental demand is thriving as IT and related industries expand. Several tier-2 markets are showing similar momentum, particularly as metro, expressway, and airport projects develop. Cities like Lucknow and Chandigarh are witnessing double-digit appreciation rates of up to 10%.

Planning ROI requires a strategic approach, where each move must balance yield, liquidity, and time. While tier-3 cities offer land-led growth potential, their appreciation rates are slower.

Focus on the key factors that influence long-term returns:

- Monitor rental demand near established job hubs.

- Prioritize areas linked to funded infrastructure projects.

- Align holding periods with the maturity of the market.

- Consider exit timelines, not just entry prices.

With these metrics in mind, understanding resale dynamics will help in exiting investments efficiently.

Assessing Resale Potential in Different City Tiers

Prime locations in tier-1 cities tend to resell quickly due to high demand. In saturated metro markets, resale activity is important. In tier-2 cities, properties near office hubs or upcoming infrastructure projects see enhanced resale potential. Tier-3 properties, while having lower entry costs, can offer significant long-term growth potential. Ultimately, demand and location will dictate resale outcomes.

Use this checklist to evaluate whether the resale potential aligns with investment goals:

- Assess demand depth beyond the excitement of new launches.

- Evaluate walkable access to jobs, public transit, and essential services.

- Investigate competing supply within a 3–5 km radius.

- Confirm planned projects through official announcements.

With RERA regulations in place in most states, developments are more streamlined, ensuring buyers’ interests are protected. Now, align these insights with the connectivity realities that drive property value.

Location and Connectivity: Key Factors in Real Estate Investment

Tier-1 cities boast well-developed roads, advanced airports, and extensive public transit systems. Connectivity is continuously improving with new metro lines, airport expansions, and major road projects, which in turn elevate property prices and resale prospects. Buyers often prioritize proximity to flyovers, expressways, metro networks, and airports. While tier-2 cities are expanding rapidly, they typically have less extensive connectivity and fewer international airport facilities. Tier-3 cities are still in the process of developing basic transport links.

Evaluate connectivity to avoid overpaying for future growth without tangible proof:

- Prioritize multi-modal transit options within reasonable commute times.

- Focus on funded infrastructure phases rather than speculative projects.

- Assess last-mile access for daily convenience.

- Consider airport access for business or rental opportunities.

Connectivity is important for both pricing power and exit confidence. The next factor to consider is whether local economies can sustain growth momentum.

Economic Growth and Development Trends in Real Estate

Tier-1 cities serve as global economic hubs, significantly contributing to the national GDP. The presence of multinational companies, manufacturing centers, and corporate offices drives housing demand. Tier-2 economies are growing through traditional industries, tourism, manufacturing, education, and startups. In cities like Coimbatore and Kochi, niche markets such as retirement homes and senior living are gaining traction. Short-term rentals are thriving in areas with strong tourism, while tier-3 cities rely more on local businesses and tourism-related activities for growth.

Link property choices to sustainable economic drivers rather than short-term cycles:

- Identify employers with long-term expansion plans.

- Diversify sectors to mitigate cyclical risks.

- Monitor tourism seasonality when estimating rental income.

- Align property types with local demographic trends.

With a clear understanding of the economic situation, individuals can refine their location and product fit based on lifestyle and sustainability trends.

Lifestyle Amenities and Sustainability in Real Estate

Tier-1 cities come with higher living costs and a strong demand for modern amenities. Gated communities are becoming increasingly popular, alongside a focus on sustainability in tier-1 real estate. Buyers are now seeking energy-efficient homes equipped with smart technology. In tier-2 and tier-3 cities, living costs remain lower, but there is a gradual shift towards gated-community living. Migration into these areas is driving demand upward, although development in tier-3 cities is progressing at a slower pace.

Consider amenities and sustainability to enhance value retention and livability:

- Target energy-efficient designs and effective water management systems.

- Ensure reliable maintenance and security standards.

- Check for adequate digital infrastructure to support remote work.

- Confirm that community services evolve alongside occupancy rates.

These criteria will help align lifestyle needs with long-term property value. With priorities established, refine investment strategies to fit budgets and timelines.

How Gurgaon Floors Facilitates Real Estate Investment Across City Tiers

Investing in real estate across tier-1, tier-2, and tier-3 cities requires careful, evidence-based decision-making. While tier-1 cities offer stability, rising entry costs can be a barrier. Conversely, tier-3 cities may reward patience, but their growth often follows slower development timelines. Tier-2 cities frequently strike a balance between affordability and potential upside as infrastructure and job markets expand. Staying attuned to market signals, monitoring risks, and basing decisions on thorough research rather than market momentum is important.

For personalized guidance on neighborhoods, infrastructure, and timing, connect with first-time homebuyer tips for tier-2 cities for a focused, no-obligation discussion.

Frequently Asked Questions About Real Estate Investment

Which tier offers the best long-term property appreciation in India?

Tier-2 cities often present strong long-term appreciation potential due to expanding infrastructure and job opportunities. Property prices in tier-2 cities can appreciate significantly as connectivity and employment opportunities grow.

Are Tier-2 and Tier-3 cities suitable for first-time homebuyers?

Absolutely! The lower entry costs in these cities make them ideal for first-time buyers seeking affordability and space. Utilize first-time homebuyer tips for tier-2 cities to balance commute, services, and future resale potential.

What factors influence ROI on property in tier-1 cities?

Consistent housing demand and robust rental markets support ROI in tier-1 cities. Economic growth in these areas also stabilizes vacancy rates and rental trajectories.

How do underwriting standards or conflicts of interest affect property evaluation across city tiers?

Bank underwriting standards may tighten loan terms in volatile micro-markets, impacting approval rates. Developer incentives can also skew choices, so it’s important to compare net prices and resale potential carefully.

How can I recover losses from real estate investments across city tiers?

Review agreements, timelines, and commitments against actual delivery to frame claims. Seek independent valuations and consult professionals for advice on exit strategies, resale, or legal remedies.

As these challenging decisions are made, it is understood that the journey can feel overwhelming. For personalized support in real estate investment, reach out to Gurgaon Floors. Contact us today to discuss your legal options and explore the best choices that align with your goals.

Add a comment